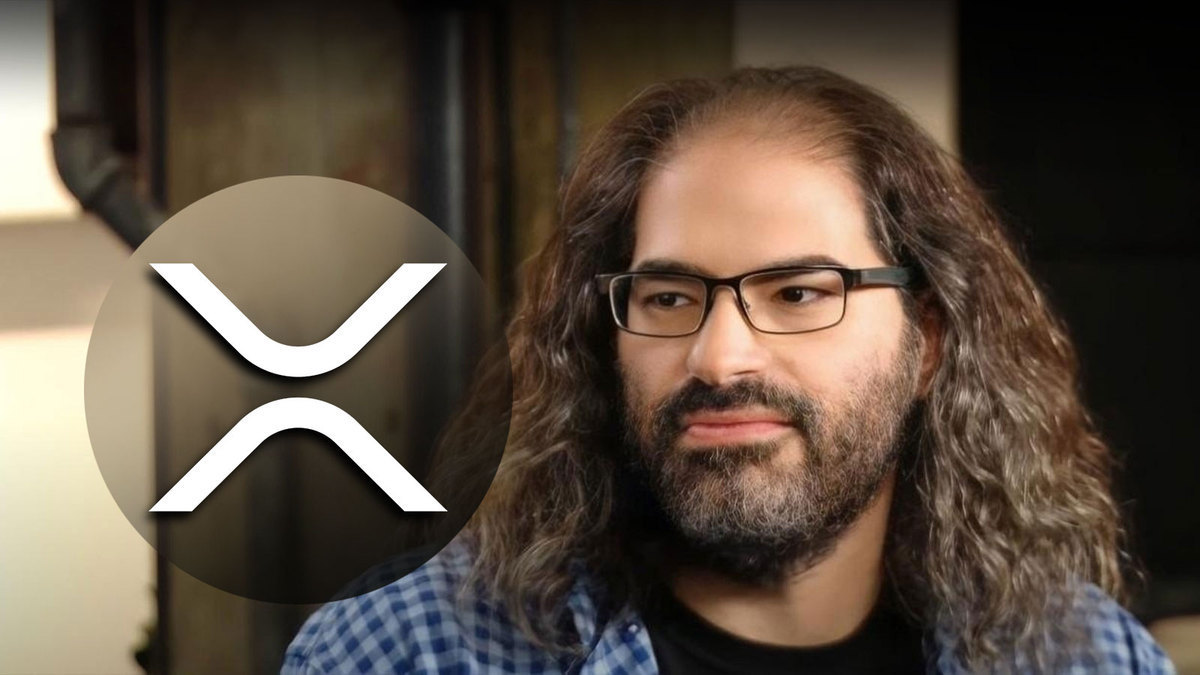

Ripple Labs CTO David Schwartz, took to X to comment on an earlier announcement made by its President Monica Long.

The Integration of XRPL

In his post, Schwartz explained that Ripple is now looking to integrate both the technical and financial features of the XRP Ledger into its business.

The reason for this move is to give clients the opportunity to enjoy the benefits that comes with utilizing Decentralized Finance (DeFi) in a secure and compliant manner.

As you’ll see in our latest blog post, Ripple is focusing on how to integrate more of the XRP Ledger’s technically and financially sophisticated features directly into our business—bringing the benefits of DeFi to our customers globally in a secure and compliant fashion. https://t.co/QLsXe2nlJN

— David “JoelKatz” Schwartz (@JoelKatz) July 19, 2024

Ripple, which was recently named among the top 250 Fintech firms by CNBC and data giant Statista, says it is focused on becoming “the #1 digital asset infrastructure provider for financial services by building the core components.”

The blockchain payments platform went ahead to explain how Ripple’s product strategy has evolved for this goal.

Ripple Blockchain Foray and Future

Notably, President Monica Long highlighted Ripple’s first foray into the blockchain ecosystem, which was cross-border settlements.

Then she went on to talk about other milestones that have followed since that time. One of such milestones was the acquisition of Metaco, a digital asset custody and technology provider that has ties with top banks around the world like BBVA Switzerland and HSBC.

Metaco was one major step towards bringing the future of blockchain payment to the present. In the future, Ripple plans to transfer Metaco into Ripple Custody with a new office in Geneva.

The Ripple President also talked about rolling out RLUSD, the firm’s United States dollar-pegged stablecoin. This will be featured on both XRPL and Ethereum blockchain. With this stablecoin, the payment platform aims to improve efficiency in key payment routes with high liquidity, like transactions from USD to EUR. According to Long, RLUSD is crafted to supplement XRP and not to substitute it.

Together with XRP, RLUSD will play a role in expanding use cases in transnational payments, precisely for institutional clients while also serving their growing needs in this area.

Disclaimer: The information provided in this article is for informational purposes only. It does not constitute investment, financial, trading, or any other sort of advice. You should not treat any of BGEcrypto’s content as such. BGEcrypto does not recommend that any cryptocurrency should be bought, sold, or held by you. Do your due diligence and consult your financial advisor before making any investment decisions.