This week marked a historic run for Ripple Labs after its RLUSD stablecoin went live amid intense volatility that the CTO addressed

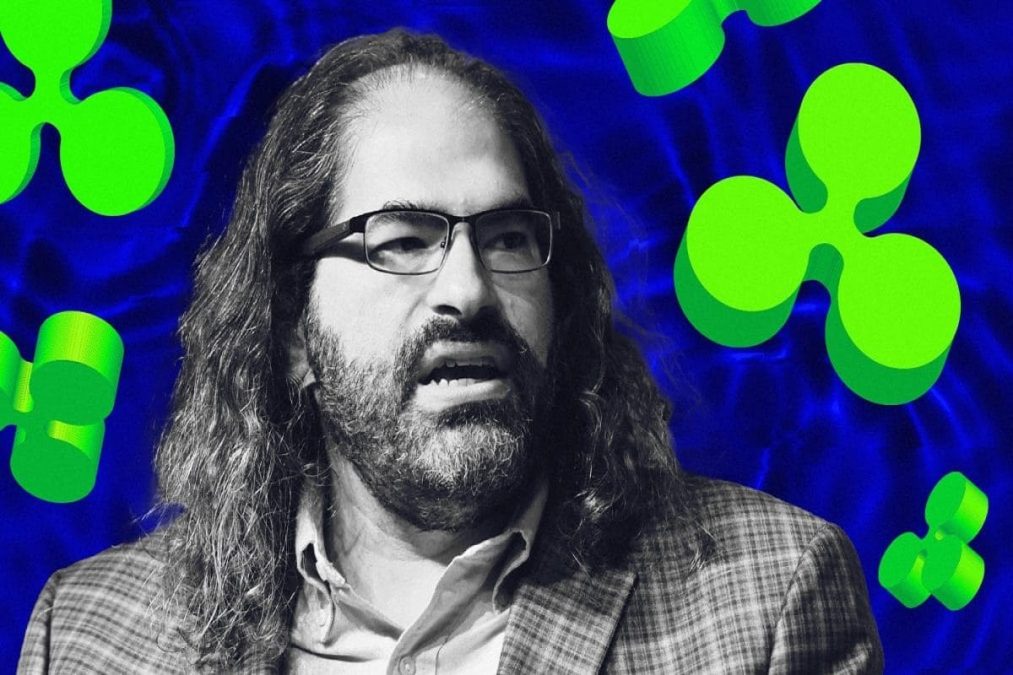

On December 17, Ripple Labs launched RLUSD, its first native stablecoin pegged to the U.S. dollar on the XRP Ledger (XRPL). This launch generated significant excitement within the XRP community, briefly pushing XRP’s price above $2.70. RLUSD’s launch also brought unexpected drama, causing a stir in the crypto community. Ripple’s CTO, David Schwartz, explained the surprise price surge of RLUSD before its launch.

RLUSD’s Abnormal Rise Explained

The unexpected pre-launch price surge of RLUSD stablecoin puzzled users. It sparked discussions on social media platforms, including X. Many were surprised to see a stablecoin, intended to maintain a 1:1 peg with the U.S. dollar, valued at $1,200.

This anomaly led to widespread speculation and debate within the crypto community. In a recent X post, Ripple’s Chief Technology Officer, David Schwartz, addressed these concerns. He explained that the limited initial supply and high demand caused the temporary price spikes.

As RLUSD goes live, there may be supply shortages in the very early days before the market stabilizes. There actually is someone willing to pay $1,200/RLUSD for a tiny fraction of one RLUSD. Tools will show you the highest price anyone is willing to pay, even if it’s just for a… https://t.co/LOx4rGiiiJ

— David “JoelKatz” Schwartz (@JoelKatz) December 15, 2024

He reassured users that RLUSD’s value will stabilize around its intended $1 peg as the supply increases. After his announcement, RLUSD has since returned to its intended value. At the time of writing, the stablecoin is maintaining its peg at $1.00, according to CoinMarketCap data. It has a total supply of $53.1 million.

Trader’s Loss Highlights Market Risks

In a notable incident, one trader’s experience highlighted the risks of early trading. He exchanged 10,000 XRP for 100 RLUSD during the early trading period.

During its launch, he effectively paid $271 per RLUSD. Once RLUSD stabilized at $1, his $27,100 investment shrank to just $100. At that moment, XRP was trading around $2.71, meaning the trader paid approximately $271 per RLUSD.

Once RLUSD’s value corrected to its $1 peg, the trader’s $27,100 investment plummeted to just $100. This event underscores the risks of trading new digital assets during volatile launch phases.

Ripple’s launch of RLUSD highlights both the potential and challenges of introducing new digital assets into the crypto market. Despite the early issues, the RLUSD’s launch has renewed interest in the XRP ecosystem. Many believe RLUSD could play a significant role in XRP’s future.

Disclaimer: The information provided in this article is for informational purposes only. It does not constitute investment, financial, trading, or any other sort of advice. You should not treat any of BGECrypto’s content as such. BGEcrypto does not recommend that any cryptocurrency should be bought, sold, or held by you. Do your due diligence and consult your financial advisor before making any investment decisions.