Bitcoin (BTC) is currently in the red as it is leading the market’s bearish sentiment at the moment. At the time of writing, the price of Bitcoin is trading at a spot price of $62,263.47, down by 2.23% in the past 24 hours per data from CoinMarketCap.

Dwindling Metrics Bugs Bitcoin Breakout Potential

Investors have been watching the price of Bitcoin closely in recent times as spot BTC ETF products have consistently received a negative flow in recent times. For a digital currency that topped $73,000 shortly before its halving event, it dropped to a monthly low of $59,651.39.

While traders and investors are not oblivious to the volatile nature of Bitcoin, there is an expectation that a rebound is imminent. True as this seems, the historical overview is not looking promising.

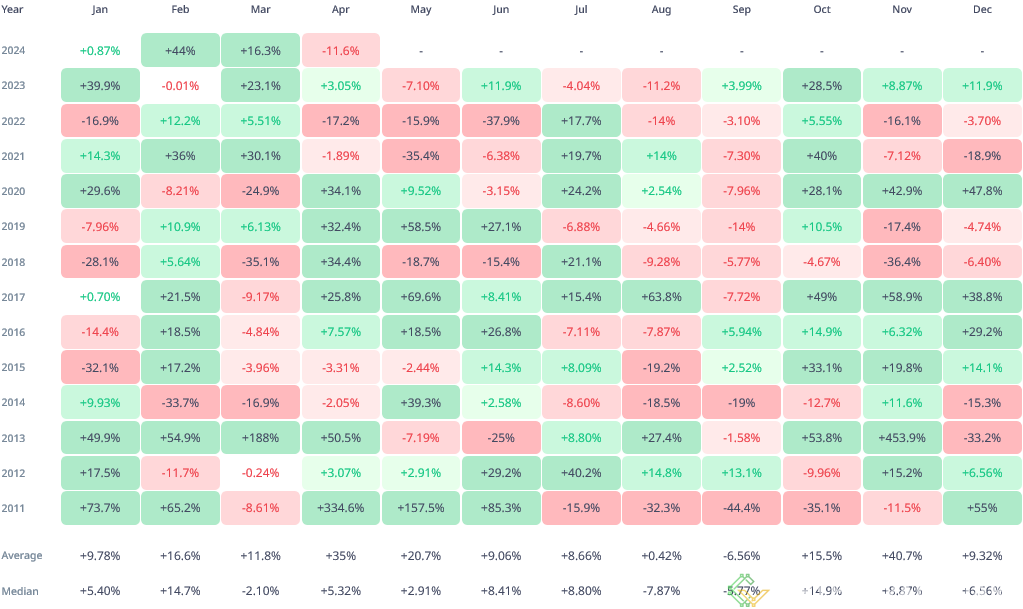

Data from Cryptorank shows that for May, the bearish trend might not have cleared off. The data shows successive bearish closes from 2021 to date. In 2021, Bitcoin closed the month of May at a bearish 35.4% slump. There was a mild boost in May 2022 but the premier coin still closed 15.9% lower. Last year, Bitcoin dropped 7.10% in May amid heated macroeconomic uncertainty.

With Bitcoin on track to close April lower, buckling the bullish 3.05% surge recorded in April 2022, the expectations of a rebound are further strained.

Halving To Make a Difference

While historical data are pivotal in financial markets, the current trend suggests that there might be a decoupling from the norm. The crypto ecosystem is notably yet to price in the impact of the Bitcoin halving event. Once there’s a full realization of the supply crunch, a massive price revival might be ushered in.

Spot Bitcoin ETFs are also a crucial catalyst that might complement this supply crunch. In all, the capitulating bull market cycle shows more is in store for Bitcoin in the long term.