Bitcoin has seen a shift in its compound annual growth rate is reducing and may settle at 8% as the top coin attains maturity, pushing it ahead of traditional assets.

Cryptocurrency traders are always out for profit-taking and have their eyes on assets with potential for huge gains. Bitcoin (BTC), the leading crypto asset, has attracted investors’ attention due to its historical growth metric.

Bitcoin Institutional Shift and Slowing CAGR

The top coin is the first and only cryptocurrency to cross $100,000. It hit an all-time high (ATH) of $109,000 in January 2025. Industry giants and traders are eyeing the next breakout that could see it flip its ATH.

Market participants anticipate that Bitcoin will continue to post an explosive growth rate.

However, Willy Woo, an influential analyst in the crypto space, has shared his insights on the likely price trajectory of the leading crypto asset.

Woo urged retail investors who view BTC as a magical asset that would always skyrocket to be realistic.

“We are well past the 2017 year where we’d see many 100s of percent growth,” he stated.

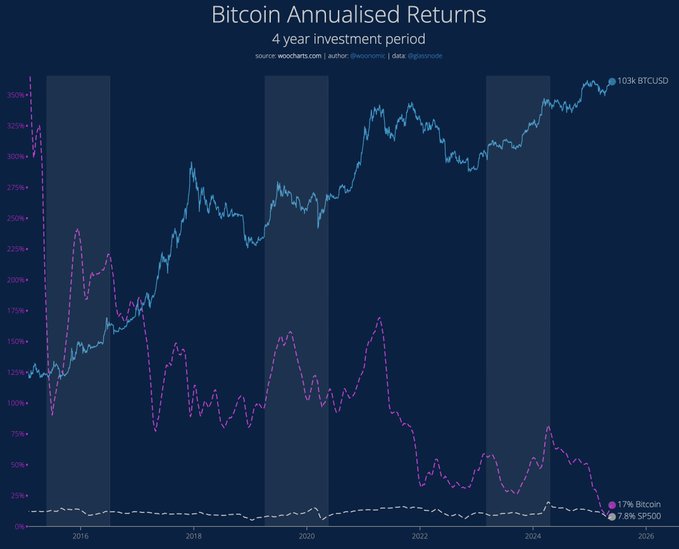

According to Woo, Bitcoin’s Compound Annual Growth Rate (CAGR) is slowing down. The CAGR is a metric that tracks the yearly growth of BTC over time. In previous years, around 2017, BTC had staggering growth and made gains annually.

The analyst believes this is no longer the case. Woo said the shift came in 2020, when Bitcoin became institutionalized and major corporations like Strategy (formerly MicroStrategy) and some sovereign wealth funds started accumulating BTC.

What Does the Future Hold for Bitcoin Investors?

Woo argues that BTC is now behaving like a “macro asset,” a long-term investment like gold, equities, and bonds. He predicts that as it absorbs more global capital, Bitcoin could reach an “equilibrium.”

This is likely a point where its growth rate aligns with broader economic fundamentals.

As per his forecast, the coin’s long-term CAGR might eventually settle around 8%. This is close to but still higher than global monetary expansion and GDP growth with approximate growth of 5% and 3% respectively.

Woo insists that even though Bitcoin growth has slowed down from its days of 100% gains, it is still outperforming most investment assets.

According to Woo, Bitcoin will continue to be bullish. He expects BTC to outpace other assets with its current 15% to 40% annual growth for the next 15-20 years.

As of this writing, Bitcoin is trading up by 2.47% at $105,506.11. The coin has gained about $3,000 in the space of 24 hours.

Disclaimer: The information provided in this article is for informational purposes only. It does not constitute investment, financial, trading, or any other sort of advice. You should not treat any of BGECrypto’s content as such. BGEcrypto does not recommend that any cryptocurrency should be bought, sold, or held by you. Do your due diligence and consult your financial advisor before making any investment decisions.